Auquan’s Daily Wrap | 9th March: What you might have missed

Samsung Electronics may face both supply disruption and earnings decline in Q1

Samsung may face both supply disruption and earnings decline in Q1

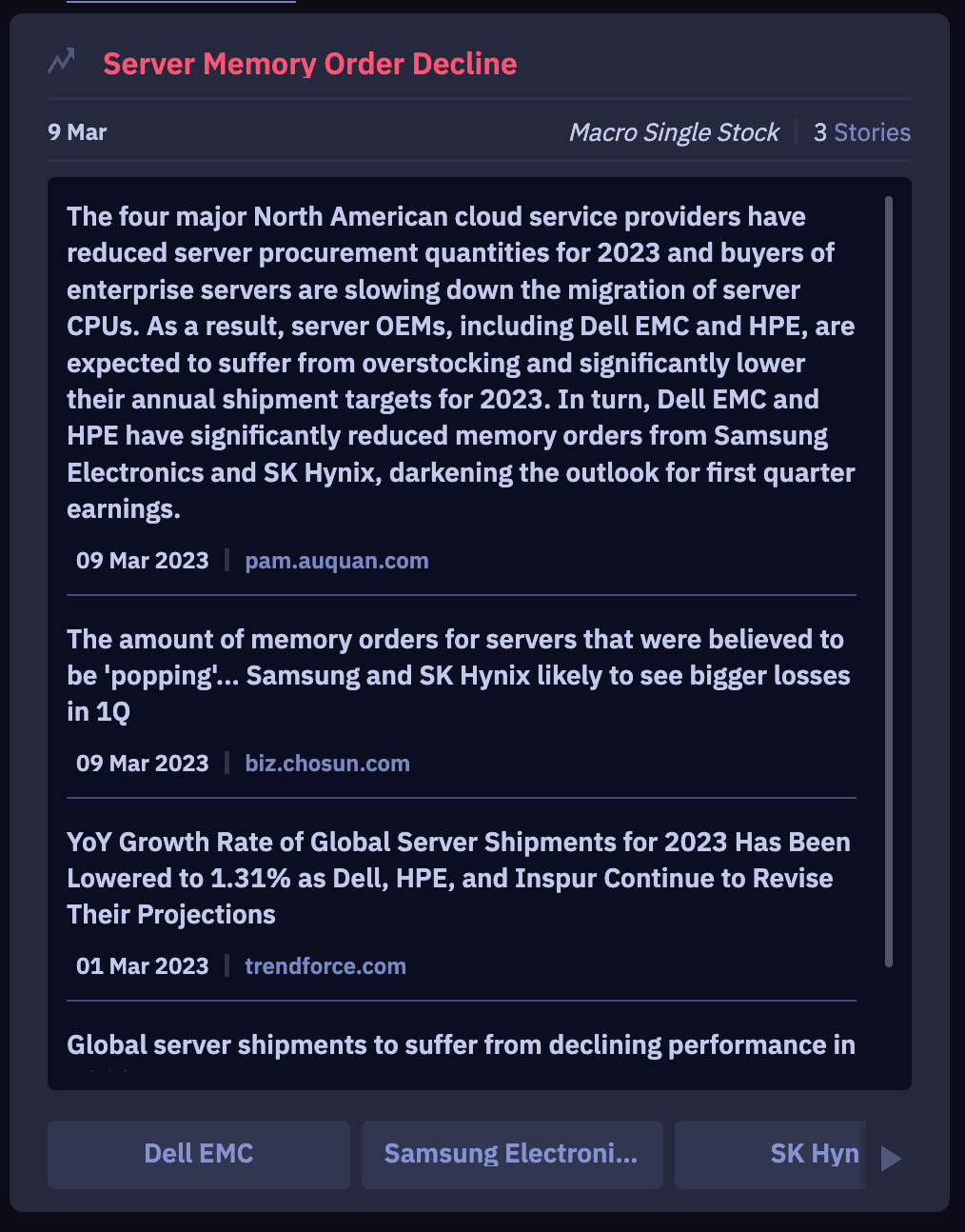

Server Memory Order Decline

- The four major North American cloud service providers have reduced server procurement quantities for 2023 and buyers of enterprise servers are slowing down the migration of server CPUs due to the economic downturn and inflation.

- The YoY growth rate of global server shipments for 2023 has been lowered to 1.31%. Server OEMs, including Dell EMC, HPE, and Inspur have revised their projections down.

- In turn, Dell EMC and HPE overstocked on existing DDR4 volumes have significantly reduced or delayed orders for DDR5.

- This darkens the Q1 earnings outlook for Samsung Electronics and SK Hynix, who expected that the replacement demand for DDR5 generation this year would partially offset the slowdown in the memory industry.

Select Sources

- March 8 | The amount of memory orders for servers that were believed to be 'popping'... Samsung and SK Hynix likely to see bigger losses in 1Q

- March 1 | YoY Growth Rate of Global Server Shipments for 2023 Has Been Lowered to 1.31% as Dell, HPE, and Inspur Continue to Revise Their Projections, Says TrendForce

- Feb 9 | Samsung Electronics playing game of chicken in memory chips

- Feb 6 | Global server shipments to suffer from declining performance in 1Q23, says DIGITIMES Research

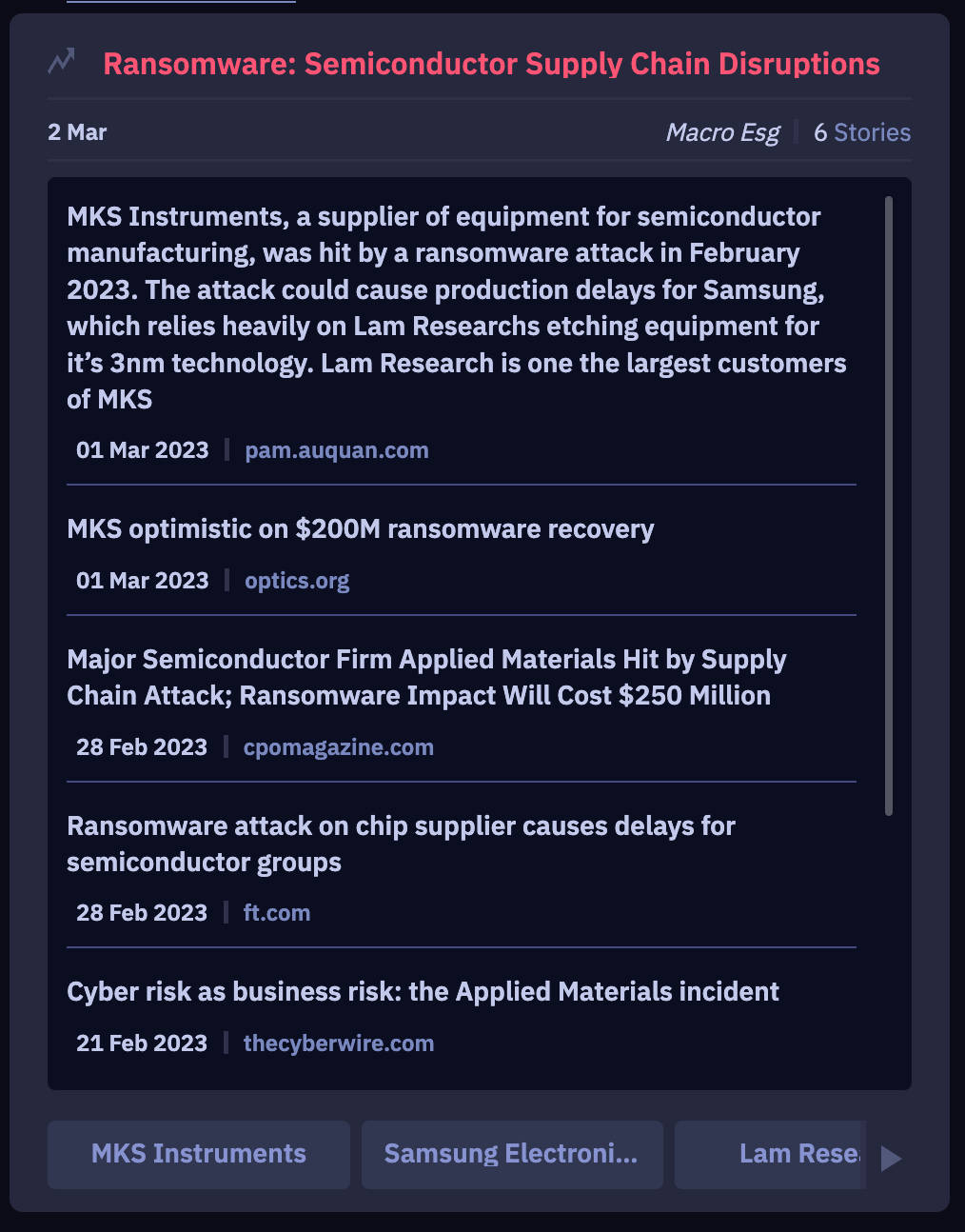

Ransomware: Semiconductor Supply Chain Disruptions

MKS Instruments recent ransomware attack that suspended its operations could lead to knock-on effects for its two largest customers - Lam Research and Applied Materials. Applied Materials has already issued a warning of a $250M revenue hit. Since Lam Research provide etching equipment for GAA technology for Samsung Electronics, this would delay 3nm production if LAM research’s supply chain has been similarly impacted.

Select Sources:

- Feb 28 | Ransomware attack on chip supplier causes delays for semiconductor groups

- Feb 16 | Applied Materials’ Sales Shortfall Linked to Cyberattack at MKS

- Feb 6 | Chip equipment maker MKS Instruments says it is investigating a ransomware attack

While you’re here…

Thanks for reading! Portfolio managers use Auquan’s Portfolio Intelligence Engine to understand, track, and minimize risks — and identify hidden opportunities.

Expand the scale and scope of your research and focus only on high-value analysis so you’re always prepared to act ahead of the market.

Visit www.auquan.com to schedule a demo.