Auquan's Weekly Wrap | 1 - 5 August: What you might have missed

Recap of the week's market activity: Consumer spending cooldown, warehouse supply chain crisis, retail profit pressure, US baby formula shortage, and more.

Top Themes

Consumer Spending Cooldown

Source: Getty Images

A slowdown in consumer spending amidst decades-high inflation has dampened multiple business' earnings' across industries. Both Uber and Deliveroo have cut forecasts, with P&G missing it's earnings. Samsung Electronics cautioned weakened chip demand for smartphone and PC makers as consumer spending is squeezed from inflationary pressure. However, some like T-Mobile have benefited with cheaper product plans attracting more price conscious consumers.

- Uber Eats in focus as inflation-hit consumers rethink ordering in

- Procter & Gamble forecasts annual profit below estimates as costs bite

- Samsung warns of weaker chip demand for phones, PCs as people shop less

- From burgers to gadgets, stressed consumers buy cheap

- T-Mobile's cheaper plans help raise forecast for subscriber growth

Warehouse Supply Chain Crisis

PHOTO: COOPER NEILL FOR THE WALL STREET JOURNAL

Retailers are having to resort to excessive markdowns in order to shift inventory. Walmart, Target, Bed Bath & Beyond, and Best Buy are among many struggling to cope with an unexpected glut of casual clothes, kitchen appliances and electronics in warehouses as consumers have pivoted away from spending on goods amongst the highest inflation in decades squeezing household budgets.

- Surging Retail Inventories Are Swamping U.S. Warehouses

- Retailers Warn Of Dropping Demand While Warehouse Inventories Swell

- Retail & Economy: Nervous Consumers and Large Inventories

- America's biggest warehouse is running out of room

- Retailers Seeking More Warehouse Space to Stow Excess Inventory

Inflation Crisis: Retail Profit Pressure

Source: Getty Images

As consumers have pulled back from discretionary spending, retailers are slashing profit outlooks, subsequently leading to organisational restructure and corporate layoffs. 7-Eleven are reported to have cut around 880 jobs, with Walmart's layoffs also in the hundreds.

- Walmart Lays Off Hundreds of Corporate Workers

- German retail sales post biggest year-on-year slump since 1994

- Walmart Cuts Profit Outlook as It Lowers Prices to Move Goods

- Convenience store chain 7-Eleven lays off about 880 U.S. employees

US Baby Formula Shortage

Source: Getty Images

Whilst European suppliers such as Danone have stepped up exports of Neocate formula and Aptamil baby formula to address shortages caused by Abbott (and enjoyed raised sales outlooks in the process), another setback has surfaced. The US food safety watchdog has suspended UK based Global Kosher’s plans to export millions of cans of formula, accusing them of submitting altered paperwork to authorities in its home country.

- FDA halts UK group's baby formula imports over 'modified' paperwork

- France's Danone raises annual sales outlook after topping Q2 estimates

- Danone sends 1.3 million cans of Aptamil baby formula to U.S. to address shortage

Themes to Watch Out

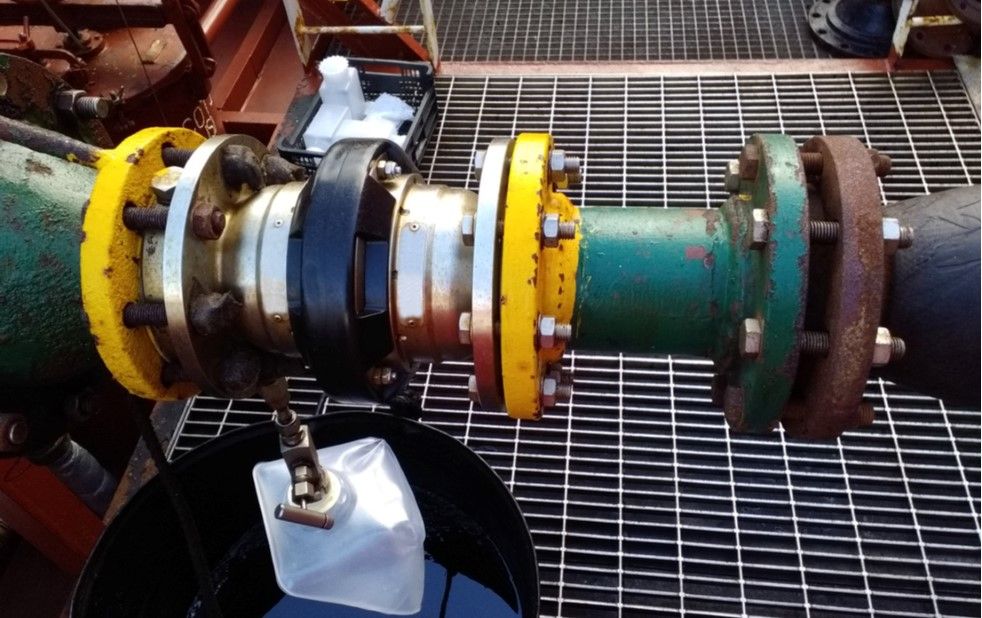

HSFO Fuel Contamination

Source: Shutterstock

Since March, growing concerns of contaminated HSFO Fuel in Singapore (causing power failures) eventually sparked an investigation by the Maritime Port Authority of Singapore. Whilst impacting more than 200 vessels fueling the world's bunker market, findings concluded no evidence that suppliers Glencore and PetroChina intentionally contaminated the HSFO being sold to vessels. However, Glencore Singapore continued to supply the fuel after tests uncovered the contamination - consequentially its bunkering license has been suspended for two months. Conversely, PetroChina promptly stopped delivery after being alerted.

- Singapore Suspends Glencore’s License for Selling Contaminated Fuel

- MPA completes its investigations into bunker fuel contamination in Singapore port

- China Merchants takes $5.2m hit on vessel due to tainted bunker

- Singapore Port Authority Says Contaminated Bunker Fuel Originated in the UAE

Thank you for reading our weekly wrap! Don't forget to subscribe to our newsletter for more insights!