Global lithium shortages: Supply and demand imbalance - Part 1

Keep track of trends thematically with Auquan's Portfolio Activity Monitor: Goldman Sachs lithium forecasts, insufficient investment in lithium mining and increasing downstream demand for EV factories and battery plants.

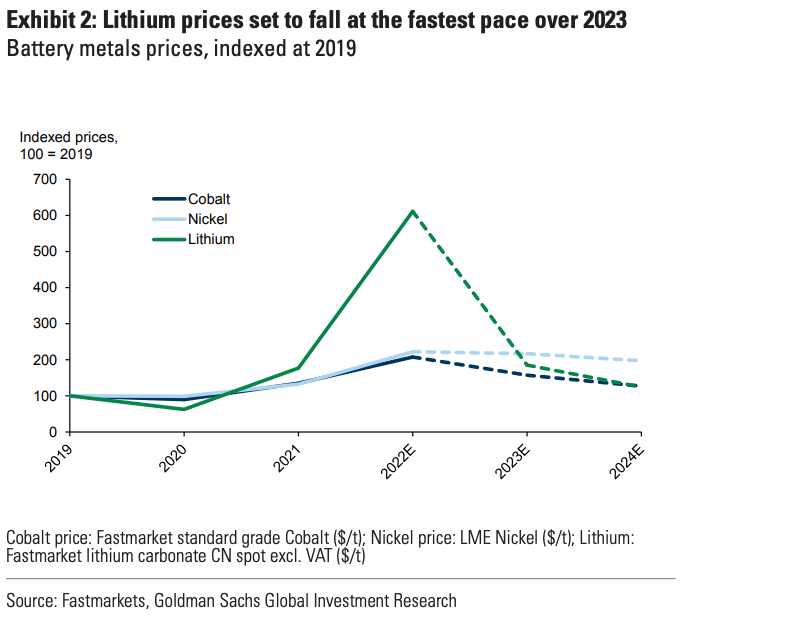

A critical challenge for global EV adoption is the shortages of metals required to produce EV batteries. Lithium, cobalt and nickel mines haven't been able to expand as quickly enough to keep up with the surging demand for EVs. Consequently, metal prices, especially lithium, have skyrocketed - lithium prices have risen 13-fold over the past two years.

This insufficient lithium supply threatens to escalate the battery and EV costs, and the costs of devices that use lithium-ion batteries such as laptops and mobile phones.

The recent Goldman Sachs research 'Battery Metals Watch: The end of the beginning' published May 29 spiked a growing debate around the availability of supply and demand of lithium.

In this article, we will highlight Goldman Sachs' lithium predictions and how Auquan can help you keep track of this trend thematically.

What did Goldman Sachs say?

Lithium galore. (Source)

Goldman Sachs' research argued that the lithium market is expected to 'pivot towards a prolonged phase of surplus starting this year', meaning that there will be an oversupply of lithium and thus a fall in lithium prices as forecasted below.

Despite the world producing 11% less lithium than it needed last year, Goldman claims that newly-built mines will produce 23% more lithium than carmakers and other businesses can use, with “significant” new lithium supply coming from China.

However, several sources, most cited being Benchmark Mineral Intelligence, have disagreed with Goldman Sachs' forecasts and said that a lithium oversupply is quite unlikely.

How can Auquan help you to keep track of this topic?

Over a month ago, Auquan flagged how the market has potentially underestimated the lithium supply/demand imbalance. Lithium-ion battery and EV manufacturers supply chains' are exposed to raw material shortages, with the outlook set to worsen as investments in downstream EV factories and battery plants are outstripping investments in upstream lithium mining.

Auquan helps you track this trend thematically on its Portfolio Activity Monitor (PAM) through aggregating stories such as below;

Lithium demand-supply imbalance debate

Goldman Sachs' headquarters in New York. (Source)

- 21 June: Eye on Lithium: What oversupply? CBA analyst says electric vehicle supply chain still screaming for more lithium

- 19 June: 3 Reasons Goldman Sachs Is Wrong About Lithium

- 16 June: Lithium shortages: threat or opportunity?

- 15 June: Column: Goldman sparks bear-bull battle in the lithium market

- 10 June: You may be stuck paying high gas prices for years as a global metals shortage sabotages the electric car revolution

- 9 June: Benchmark: Here's what Goldman got wrong about lithium prices

- 8 June: Electric cars could get cheaper as a crucial component in them drops in price

- 2 June: Goldman Sachs Got It Totally Wrong, Providing Buying Opportunity On Lithium Americas

- 2 June: 'Goldman is wrong': Lithium miners brush off share price rout

- 1 June: Goldman Sachs has bad news for metals investors and good news for EV makers

- 29 May: Goldman Sachs Battery Metals Watch: The end of the beginning

Lack of upstream lithium mining investments

Secretary of State Jose Fernandez (right). Credit: OECD. (Source)

- 27 June: New US programme targets rare minerals needs for EVs and solar panels

- As several African nations ask for 'foreign investment to extract critical minerals such as lithium, manganese and cobalt, The Minerals Security Partnership will work towards providing this for the development of EV batteries and solar panels.

- Despite this new programme, mining firms are reluctant to invest in some major resource-rich countries due to 'poor governance standards' and a 'lack of transparency'. US Secretary of State Jose Fernandez has mentioned not promoting a 'risk curse' in these African countries, also known as an 'expression used to describe the risk that the exploitation of natural resources will fuel corruption, instability or conflict.'

- 23 June: Will Soaring Lithium Prices Spark Demand Destruction?

- 21 June: The Mining Industry Is Replicating The Oil Sector Crisis

- 19 June: Mining Firms’ Cautious Spending Threatens Shift to Green Energy

- 17 June: Inadequate mining investment will hold back the green energy transition, PwC warns

- 15 June: As EVs drive off with Li-ion supply, the push to stationary storage alternatives accelerates

- 24 May: One Mine Auction Draws 3,448 Bids Amid Scramble For Lithium

- 29 Apr: China battery maker CATL suffers profit fall as costs soar

Downstream demand is outstripping upstream supply

A BMW iX EVis seen displayed at the BMW booth during a media day for the Auto Shanghai show in Shanghai. Reuters/Aly Song

BMW starting electric car production in the Lydia plant, BMW's third car assembly facility in China, is just one example that indicates that investments in downstream EV factories and battery plants are outstripping investments in upstream lithium mining.

- 23 June: Stellantis invests €50mn in lithium start-up to secure car battery metals

- 23 June: BMW starts production at new $2.2 bln China plant to ramp up EV output

- 21 June: Honda China venture begins building Guangdong EV factory

- 21 June: Where will Rivian place its European EV factory?

- 13 June: Ferrari plans to expand Maranello plant in preparation for EV transition

- 25 May: South Korean EV battery makers in $13 billion spree to win U.S. market

- 24 May: Stellantis picks Indiana for its $2.5 billion EV battery factory with Samsung

Lithium supply chain issues

'The photograph on the mining conglomerate’s social media account showed 70 ethnic Uyghur workers standing at attention under the flag of the People’s Republic of China. Qilai Shen/Bloomberg'

- 20 June: Battery metals: How quickly can supply ramp up?

- 20 June: Red Flags for Forced Labor Found in China’s Car Battery Supply Chain

- 6 June: All Eyes on Lithium!

- 31 May: Red flags over lithium mining for green vehicles

- 24 May: Lithium mine investments aren't keeping up with the EV supply chain

- 23 May: The battle for lithium: A Chinese mine just sold for 596 times the opening price

- 4 May: Will looming lithium shortage undermine EV revolution?

- 22 Apr: A top lithium expert agrees with Elon Musk that there’s not enough of the crucial metal to meet booming demand

In the next piece for this analysis, we'll look at in depth research points on how Goldman may have got their lithium pricing prediction wrong.